Design | Build | Protect

An evidence driven approach to wealth management that integrates your life and financial plan. Your values, needs, concerns and hopes are at the forefront of everything we do.

Personalized Financial Solutions

Global Financial Advisory Services provides personalized financial solutions that take into account all aspects of your financial life and offer guidance, clarity of thought, and expertise to help you gain confidence in a more secure financial future.

We are committed to transparency and building enduring partnerships with our clients based on mutual trust, shared values and sound investment strategies. Together, we can create a comprehensive, long term plan that reflects what is most important to you.

Download Our BrochureOur Approach

Three simple words serve as a guide to keep your values, needs, concerns and hopes at the forefront of everything, from the big picture to the smallest of details.

Design

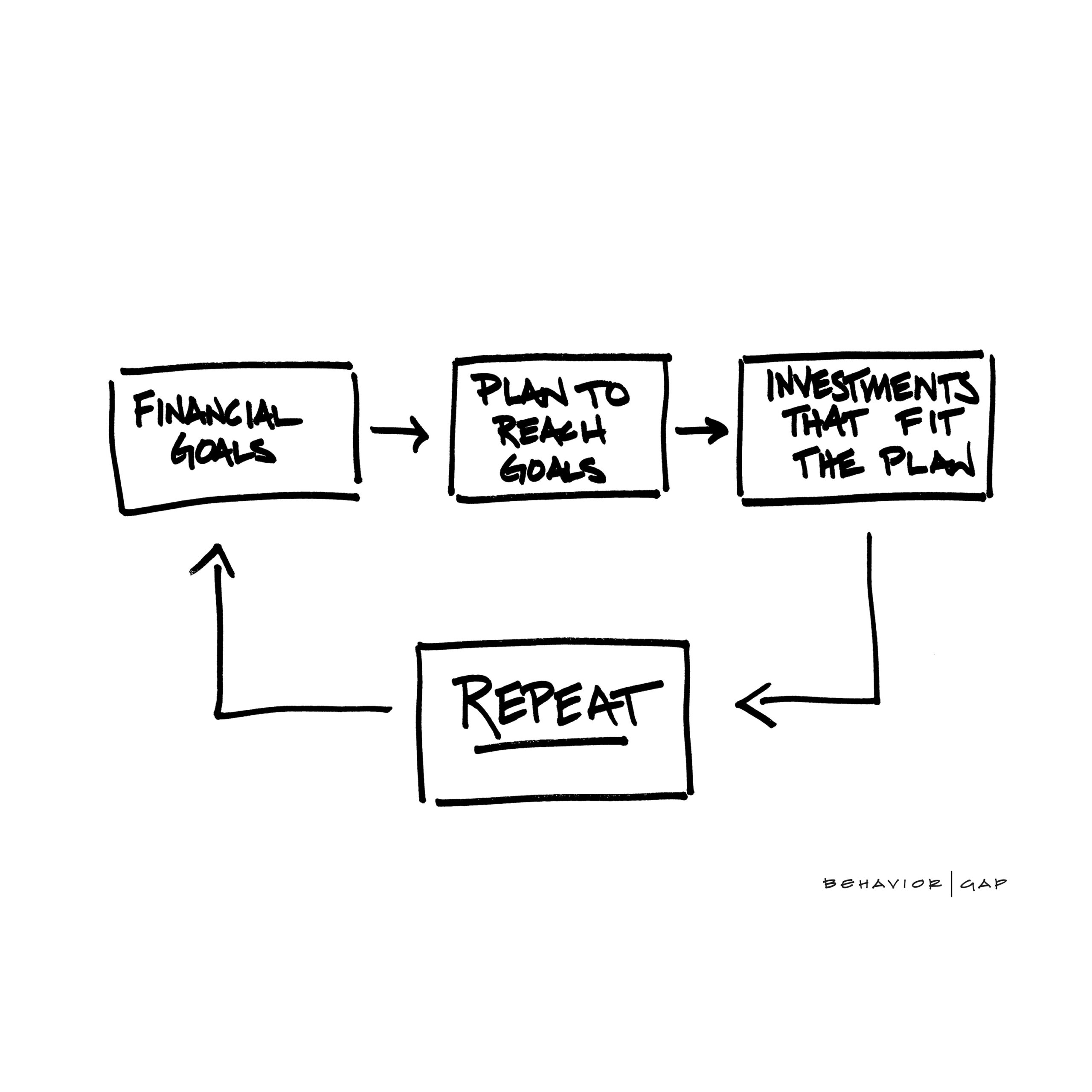

Embark on a personal discovery process to identify elements of your life that will shape the design of your financial strategy. We explore, understand and clarify your life and financial goals.

Build

Backed by a comprehensive range of resources, we build a plan that's right for you with distinct objectives and attainable action items using extensive research and evidence driven strategies.

Protect

Regular check-ins help protect your plan and allow you to measure progress toward your goals and adjust as needed. We stay on track through continual analysis, advice and education.

The Elements of a Wealth Strategy

Money, goals, life, and impact, your financial strategy is more than just investment decisions. Your dreams and passions are too important to leave to chance.

Money

Goals

Life

Impact

Design Financial Planning

One of the most important components of any successful advisory relationship is truly understanding who you are. Your life is unique, so your plan should be too. Our collaborative approach centers on your future and is intended to help you gain greater clarity on your life goals and challenges.

To do this, we will focus together on a number of important areas:

- Today: What are your top priorities and goals?

- Future: What plans have you made for the future? What values impact your views?

- Concerns: What financial issues keep you up at night?

We help you clarify, prioritize and address a wide variety of goals in a number of important areas to create a Financial LifeMap.

Build Investment Management

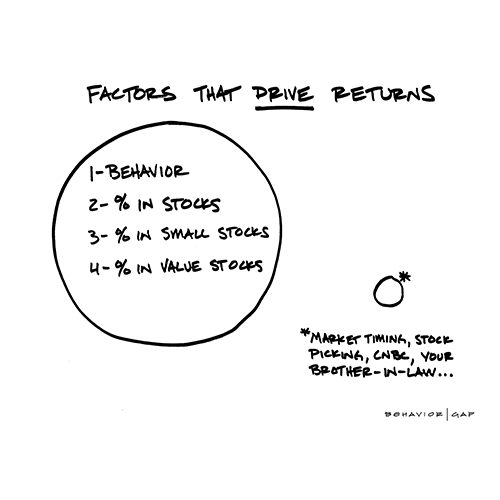

For most of us, investing is what makes it possible to achieve our lifetime goals. That is why we want to gather as much expertise on your side as possible. Our process incorporates the research of many great thinkers and economists, including pioneers in behavioral finance and 11 Nobel Laureates.

Decades of research show how you may be able to increase your probability for long term success:

- Find the right portfolio allocation between stocks and bonds

- Diversify among international and U.S. stocks to help manage volatility

- Potentially increase your returns by investing in riskier companies, including small and value companies

- Use evidence driven strategies rooted in academic research

Protect Relationship Management

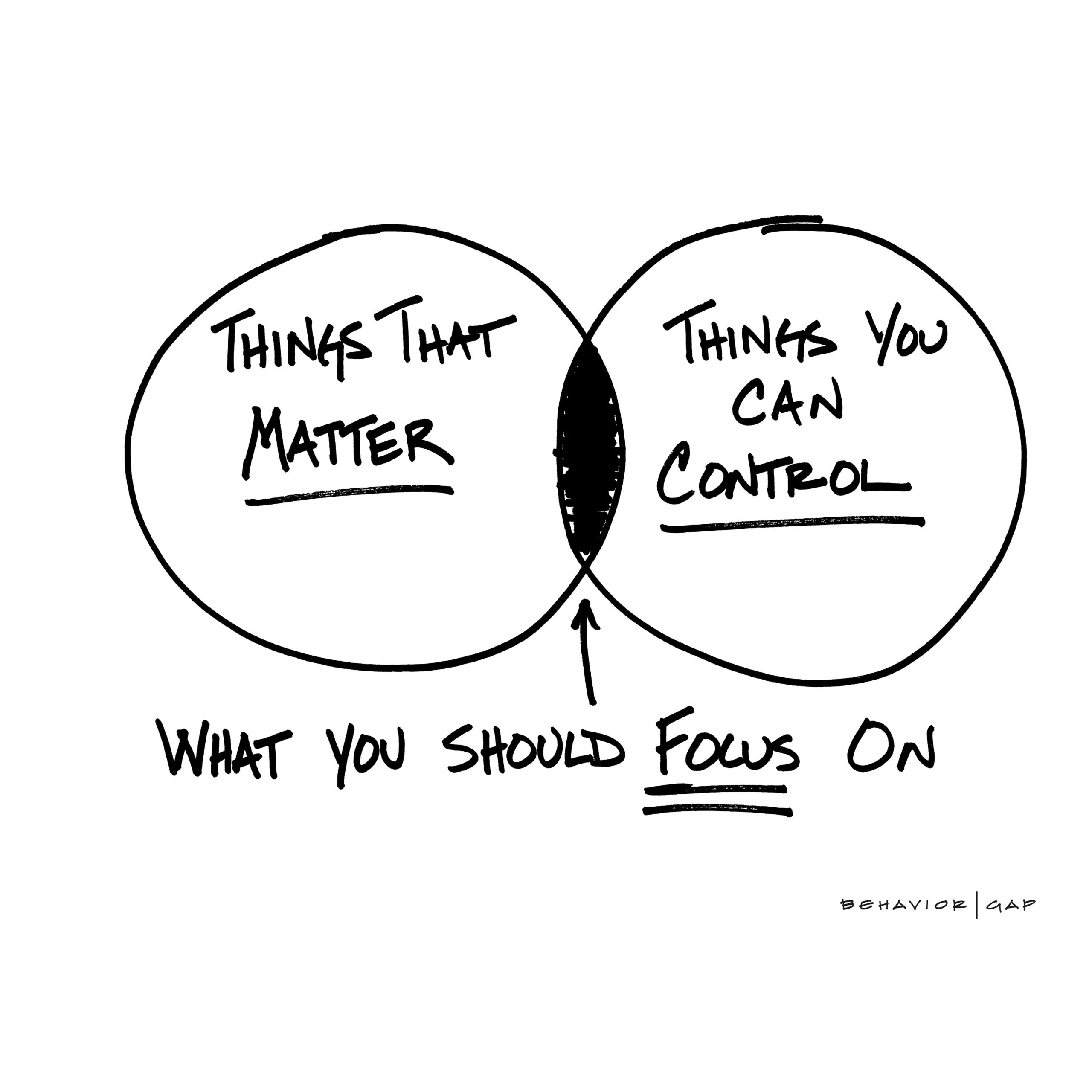

Keeping your plan on track may be the most challenging, and the most important, part of being a long term investor. Life isn't linear. Your plan shouldn't be either.

There are several ways we work together to help you achieve your goals:

- Rebalancing your portfolio to keep it in line with your risk tolerance

- Providing you with ongoing education and guidance to keep emotions in check

- Keeping pace with any changes in your life or goals through ongoing rediscovery

- Continuously assessing your progress towards meeting your objectives

- Adapting your plan as life events unfold

Our Fiduciary Commitment to You

As a registered investment adviser, we are legally and ethically bound to act in your best interest, not ours.

Your Interests First

We never put our financial interests ahead of yours when making recommendations. Every decision is guided by what's best for you and your family.

Transparent & Honest

We avoid misleading statements and provide clear information about our services, any conflicts of interest, and all fees associated with your accounts.

Prudent Advice

We meet a professional standard of care when making investment recommendations, backed by research and tailored to your unique circumstances.

Advisors

Our experienced team of fiduciary advisors is dedicated to helping you achieve your financial goals.

David Garelick, EA, CFP®, AIF®

CEO/President

David is committed to clients for the long term and acts in a fiduciary capacity. He helps clients in all aspects of their financial lives with personalized advice.

View Full Bio →

Peter Garelick, CFP®, AIF®

Wealth Advisor

Peter is a Certified Financial Planner™ professional who specializes in providing comprehensive financial guidance with a holistic approach.

View Full Bio →

Bart Brewer, CFA®, EA, CFP®

Portfolio Consultant

Bart has over 40 years of experience in financial services and has been with Global since the mid-90s. He has logged 12,000+ hours training financial professionals and is a FINRA Board of Arbitrators member.

View Full Bio →Frequently Asked Questions

Our advisory fees are based on a percentage of assets under management (AUM), calculated on a tiered schedule:

- 1.00% on the first $500,000

- 0.80% on the next $500,000

- 0.60% on the next $1,000,000

- 0.50% on assets over $2,000,000

This structure aligns our interests with yours, as your portfolio grows, you benefit from lower marginal rates. We provide full transparency about our fees before you engage our services, and you can review our complete fee schedule in our ADV Part 2 disclosure.

A Certified Financial Planner (CFP®) is a financial professional who has met rigorous education, examination, experience, and ethics requirements set by the CFP Board. CFP® professionals must complete a bachelor's degree, pass a comprehensive exam, have three years of financial planning experience, and adhere to fiduciary standards that require putting clients' interests first.

An Accredited Investment Fiduciary (AIF®) is a professional designation awarded by the Center for Fiduciary Studies. AIF® designees have demonstrated a thorough knowledge of fiduciary responsibility and the ability to implement investment best practices. This designation signifies that an advisor has met rigorous training standards and is committed to managing investments in the best interest of their clients, following a prudent investment process.

As an independent Registered Investment Adviser (RIA), Global Financial Advisory Services is registered with the SEC and legally required to act as a fiduciary, putting your interests first. Unlike advisors at large banks or wirehouses who may be limited to proprietary products or earn commissions on sales, our independence means we have no conflicts from corporate sales quotas or in-house investment products. We select investments solely based on what's best for you, with full transparency about our fees and recommendations.

A fiduciary financial advisor is legally obligated to act in your best interest at all times. Unlike advisors held to a suitability standard, fiduciaries must put your needs ahead of their own and disclose any potential conflicts of interest. Our advisors are both CFP® professionals and Accredited Investment Fiduciaries® (AIF®), which means they adhere to the highest fiduciary standards in the industry.

Evidence driven investing is an approach backed by decades of academic research and the work of Nobel Laureates. Rather than trying to time the market or pick individual stocks, this strategy focuses on factors proven to deliver long term returns: broad diversification, exposure to small and value companies, low costs, and maintaining discipline through market cycles.

Design | Build | Protect is our comprehensive wealth management methodology. Design involves understanding your unique goals, values, and circumstances. Build creates a customized financial plan using evidence driven strategies. Protect provides ongoing monitoring, education, and adjustments to keep your plan on track as life evolves.

We offer comprehensive financial planning services including retirement planning, investment management, tax optimization strategies, risk management, estate planning coordination, college funding planning, and socially responsible investing. Our holistic approach considers all aspects of your financial life and how they interconnect.

We serve clients across the United States and work with many of our clients remotely through virtual meetings. We also have two office locations:

Sherman Oaks (15260 Ventura Blvd., Suite #1750) — serving the San Fernando Valley and greater Los Angeles area, including Encino, Lake Balboa, Studio City, Tarzana, Woodland Hills, Toluca Lake, and North Hollywood.

Valencia (23822 Valencia Blvd., Suite #304) — serving the Santa Clarita Valley, including Valencia, Santa Clarita, Stevenson Ranch, Newhall, Saugus, and Castaic.

You can schedule a complimentary initial consultation by booking online, emailing info@gbmi.com, or calling the office at (661) 286-0044. We offer complimentary discovery meetings to discuss your financial goals and determine if we're a good fit for your needs.

Start Your Journey Today

We invite you to a complimentary introductory meeting to discover how Global Financial Advisory Services can assist you in creating a better financial future. Your best interests are at the center of our planning approach.

Schedule a Consultation Download Brochure