PPP Flexibility Act

Click Here to download the PDF

The Paycheck Protection Program Flexibility Act

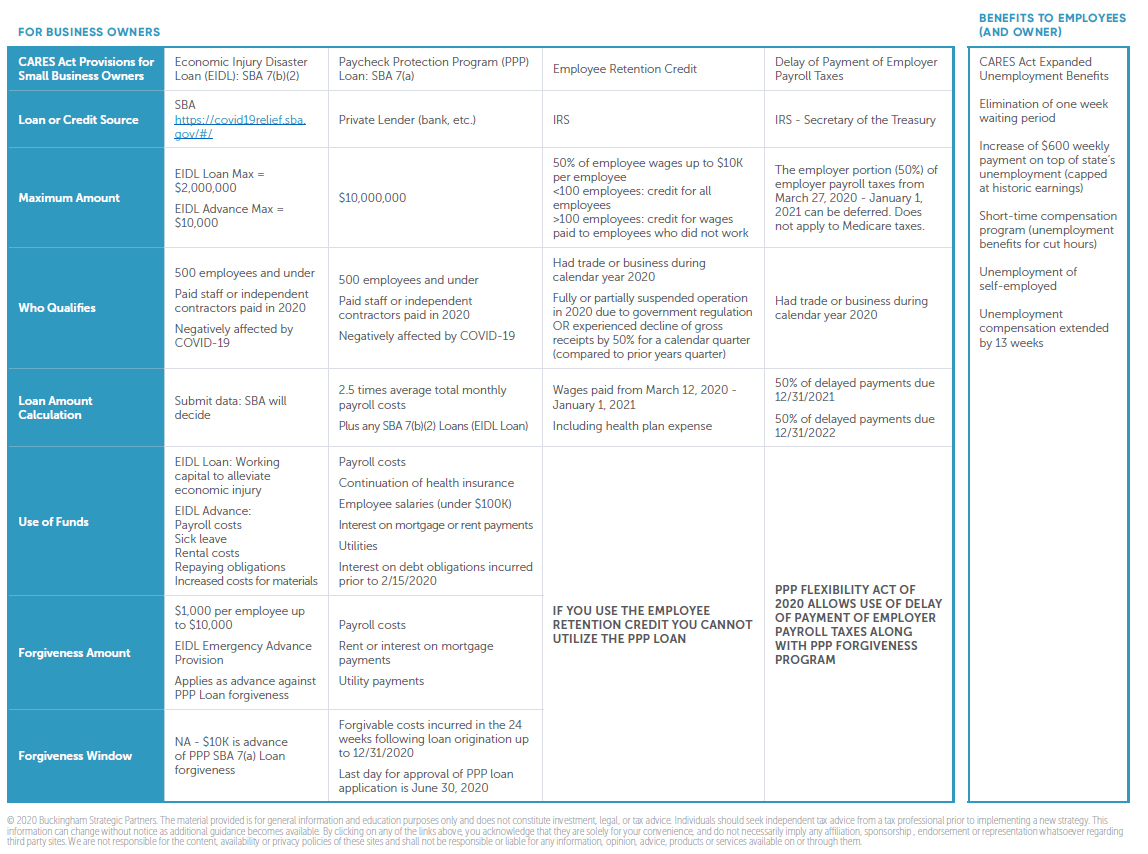

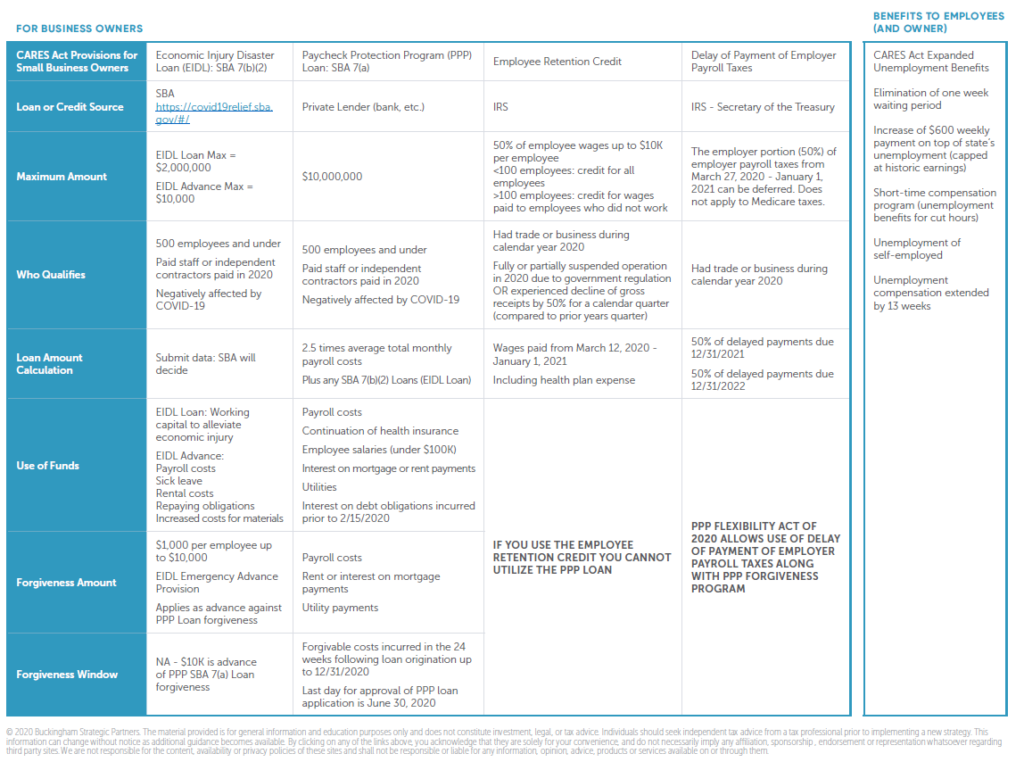

On Monday, June 8, U.S. Treasury Secretary Steven T. Mnuchin and Small Business Administration (SBA) Administrator Jovita Carranza issued a joint statement regarding the Paycheck Protection Program Flexibility (PPP Flex) Act, providing some valuable new insights in the following areas:

According to the statement, PPP loan recipients will NOT have to spend at least 60% of their loan proceeds on payroll in order to qualify for any level of forgiveness. Rather, despite the fact that the plain language of the Paycheck Protection Program Flexibility Act calls for just that, the Treasury and SBA will administer the 60% requirement in a manner similar to the way it imposed its pre-PPP Flex act 75% requirement. Accordingly, at least 60% of the forgiven amount of a PPP loan must be attributable to payroll expenses. Or, put differently, no more than 40% of the forgivable portion of a PPP loan may be for non-payroll expenses.

The statement confirms that while the covered period of PPP loans has been extended until December 31, 2020, the last day for approval of a PPP loan application remains June 30, 2020.

The full joint statement can be read here